The Only Guide for Bankruptcy Attorney

Wiki Article

The 3-Minute Rule for Bankruptcy Attorney

Table of ContentsThings about Bankruptcy Lawyers Near MeBankruptcy Information Things To Know Before You Get ThisThe Ultimate Guide To Bankruptcy Lawyers Near MeAn Unbiased View of Bankruptcy BillThe Main Principles Of Bankruptcy Bill Unknown Facts About Bankruptcy Benefits

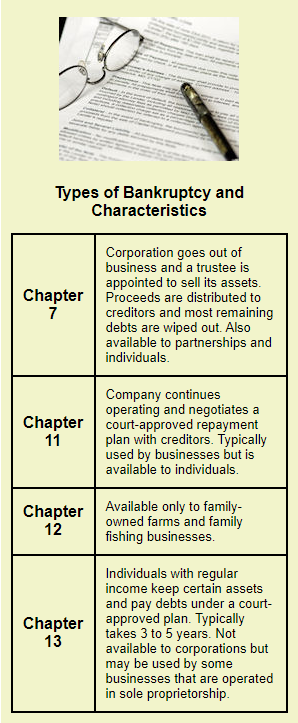

The two types of bankruptcy relieve debt in different ways. Chapter 7 bankruptcy, also called "straight personal bankruptcy," is what the majority of people possibly think about when they're taking into consideration submitting for insolvency. Under this type of bankruptcy, you'll be called for to permit a federal court trustee to oversee the sale of any type of possessions that aren't excluded (vehicles, occupational tools and fundamental household home furnishings might be exempt).Here are a few of the most usual and important ones:: This is the individual or firm, selected by the bankruptcy court, to act on behalf of the lenders. He or she evaluates the borrower's application, liquidates building under Chapter 7 filings, and distributes the proceeds to financial institutions. In Phase 13 filings, the trustee additionally oversees the debtor's settlement plan, receives settlements from the borrower and also pays out the cash to financial institutions.

Once you've filed, you'll additionally be called for to finish a course in personal monetary monitoring prior to the personal bankruptcy can be discharged. Under certain scenarios, both needs might be waived.: When insolvency procedures are full, the insolvency is thought about "released." Under Chapter 7, this happens after your properties have actually been marketed and financial institutions paid.

4 Easy Facts About Bankruptcy Bill Shown

The Bankruptcy Code requires individuals who want to submit Phase 7 bankruptcy to show that they do not have the methods to repay their debts. The need is planned to reduce abuse of the personal bankruptcy code.If a debtor fails to pass the methods test, their Phase 7 personal bankruptcy might either be rejected or converted into a Chapter 13 proceeding. Under Phase 7 insolvency, you might consent to proceed paying a debt that might be released in the proceedings. Declaring the account and also your dedication to pay the financial debt is typically done to allow a debtor to keep an item of collateral, such as a cars and truck, that would otherwise be taken as component of the bankruptcy proceedings.

Insolvencies are thought about adverse information on your credit history record, and also can affect just how future loan providers see you - bankruptcy benefits. Seeing a bankruptcy on your credit score data might prompt lenders to decline expanding you credit scores or to provide you greater rate of interest prices and less desirable terms if they do determine to offer you credit rating.

Bankruptcy Bill Fundamentals Explained

Bankruptcy details on your credit score report may make it really tough to get added debt after the personal bankruptcy is released at least until the info cycles off your credit history record.Research study financial obligation combination finances to see if combination can decrease the overall amount you pay and also make your debt much more convenient. Back-pedaling your financial debt is not something your lenders want to see occur to you, either, so they might be prepared to collaborate with you to set up an extra possible payment strategy.

The 7-Second Trick For Bankruptcy

Monitoring your debt record. Developing as well as sticking to an individual budget plan. Using debt in small means (such as a safeguarded debt card) and paying the balances completely, right now.Insolvency is a lawful proceeding started when a person or organization is not able to repay superior financial obligations or commitments., which is much less typical.

All insolvency cases in the United States are managed with federal courts. Any type of choices in federal bankruptcy instances are made by an insolvency judge, consisting of whether a debtor is qualified to submit and also whether they need to be released of their financial obligations. Management over insolvency cases is often handled by a trustee, an officer designated by the United States Trustee Program of the Department of Justice, to represent the debtor's estate in the proceeding.

How Bankruptcy Attorney Near Me can Save You Time, Stress, and Money.

Their liked shareholders, if any type of, may still receive settlements, though common shareholders will certainly not. As an example, a housekeeping business filing Phase 11 insolvency could boost its prices slightly and also provide more solutions to become successful. Chapter 11 personal bankruptcy permits business to continue conducting its business activities without interruption while dealing with a financial debt settlement strategy under the court's guidance.Phase 12 insolvency supplies alleviation to family farms as well as fisheries. They are allowed to preserve their organizations while functioning out a strategy to repay their financial debts. Phase 15 insolvency was added to the regulation in 2005 to deal with cross-border situations, which entail borrowers, properties, financial institutions, and also various other celebrations that may remain in greater than one country.

read this Not all financial debts certify to be discharged. Several of these consist of tax obligation claims, anything that was not detailed by the debtor, child assistance or alimony repayments, injury financial debts, and debts to the federal government. Additionally, any type of secured lender can still enforce a lien versus residential property possessed by the debtor, provided that the lien is still legitimate.

Rumored Buzz on Bankruptcy Attorney

When an application for personal bankruptcy has been submitted in court, creditors receive a notice as well as can object if they pick to do so. If they do, they will need to file a problem in court prior to the due date. This brings about the filing of an enemy continuing to recover cash owed or enforce a lien.Report this wiki page